Health professionals call osteoporosis a “silent disease” because most individuals don’t realize they have it. Fortunately, if you’re on Medicare, you can search online to learn more about what’s covered if you’ve been diagnosed with osteoporosis.

As a “silent disease,” a broken bone for those with osteoporosis is typically the first sign that something is wrong – and by then, it may be too late. You need to get tested for osteoporosis early on so you can get treatment.

What is Osteoporosis?

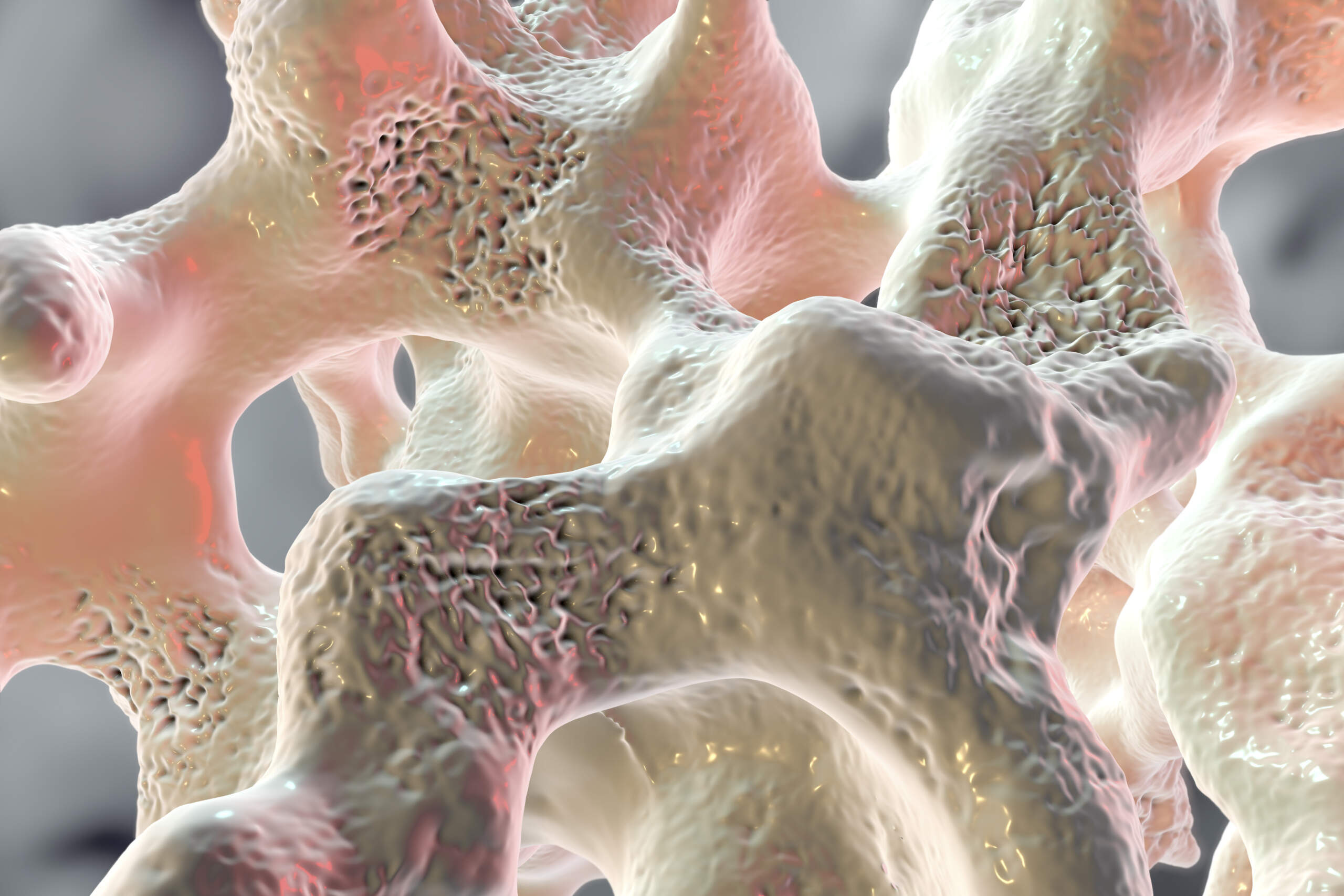

Osteoporosis is a bone condition, one that leads to brittle, weak bones over time. As it progresses, osteoporosis can weaken your bones so much that even a fall or a simple activity that puts stress on your bones – like bending over or coughing – can fracture or break them. In America alone, approximately 54 million people have osteoporosis – and it’s estimated that one in every two women and one in every four men aged 50 and older will eventually break a bone because of osteoporosis.

As we age, our bones naturally break down and are replaced with new, living tissue. But when your body isn’t able to create new bone as quickly as you’re losing old bone, osteoporosis is present.

Men and women can both develop osteoporosis. It’s most common in women who are beyond menopause, and it typically affects seniors rather than those who are young. And when osteoporosis appears, it often leads to fractures or broken bones in the hip, wrist, or spine. Over time, it can lead to serious complications like your spine crumbling or broken and fractured bones even with little stress.

Does Medicare Cover Everyone Who Has Osteoporosis?

Because osteoporosis is so common in older individuals, it’s important to understand how – and if – Medicare covers osteoporosis-related costs and needs. As you get older, you could wind up relying on your Medicare plan for osteoporosis care and treatment. And you don’t want to discover your health concerns aren’t covered.

Medicare does offer coverage for individuals with osteoporosis. However, the coverage is different for men and women.

Coverage is more limited for men who may have or have been diagnosed with osteoporosis. Screening isn’t covered, and if it is, it’s considerably more difficult to get approved. Even women are limited in Medicare coverage when it comes to diagnosing osteoporosis; screenings are only covered if you meet certain criteria and requirements, like x-rays that show possible osteoporosis.

So, Medicare may not cover every aspect of osteoporosis diagnosis, assessment, and treatment. But there is a way to know for sure: you can search online and check the latest Medicare coverage documents to know what is and is not covered.

You Must Meet Certain Requirements and Conditions

If you are diagnosed with osteoporosis and require treatment, you may be able to get your treatment covered under Medicare. Both Medicare Part A and Part B cover certain osteoporosis treatments, and you may be able to take advantage of this.

Here’s how it works. Medicare Part A and Part B will help pay for certain injectable drugs that treat osteoporosis. These plans will also cover visits by a home health nurse so they can inject the drug for you. In order to qualify for this coverage, you’ll just need to meet these conditions:

- Be a woman.

- Be eligible for Medicare Part B.

- Meet the criteria for Medicare’s home health services.

- Have a bone fracture that’s certified by a doctor to be related to postmenopausal osteoporosis.

- Have a doctor certify that you’re unable to learn how to inject the drug yourself and that your family or caregivers cannot give you the injection.

If you don’t meet these conditions, you may not be able to have your osteoporosis treatment covered under Medicare. Additionally, men are not eligible for this coverage; it’s only available for women.

Medicare Pays for Most of the Cost

If you do qualify for coverage under Medicare Part A and Part B for osteoporosis treatment, then a significant portion of the cost of your medication will be taken care of. Medicare pays for most of the cost of these treatments for eligible individuals.

With Original Medicare – Parts A and B – you’ll pay just 20 percent of the Medicare-approved cost of your osteoporosis injectable drug. And you won’t have to pay anything at all for the home health nurse visits for injections.

Keep in mind that the Part B deductible does apply. So, it’s important to talk with your doctor or pharmacy to understand how much your medication will cost you once Medicare pays its portion.

If you want to learn more about what, exactly, Medicare covers in regards to osteoporosis, it’s important to search online. You can find out the specifics of your coverage, along with any special requirements for osteoporosis treatments. And then you’ll know exactly how much you’ll be responsible for.